Middle Township Approves Contract for Inclusive Playground

Middle Township Approves Contract for Inclusive Playground

Goshen Complex project will replace outdated ADA play area. Second project slated.

opens in a new window opens in a new window

opens in a new window

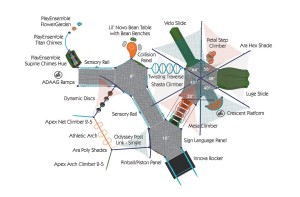

On April 8th, Middle Township Committee approved a contract with Landberg Construction, LLC to construct a new, ADA accessible playground at the Goshen Sports Complex. The new amenity will replace the current ADA playground which was closed several months ago due to safety concerns.

The approximately $392,000 project is designed to allow all children equal access to participate in play, regardless of ability, age or comfort-level. The goal is to offer all children a variety of activities, at varying skill levels within the same, safe and creative space. The area is designed to promote cognitive, social, emotional and imaginative skill development in children of all abilities.

“We are excited to move this project forward for all of our young children,” Committee Jim Norris said. “It is so important to foster public spaces that are safe and inviting for kids of all skill levels. We look forward to opening the ADA accessible playground this Fall.”

Norris, who oversees the Township Recreation Department, shared plans for a second playground, now in the planning and bidding process. This project would replace the current playground adjacent to the Goshen Complex Snack Stand.

$478,000 in funding towards the two playground projects is being provided by the New Jersey Department of Community Affairs.